United States Paper Money

United States Paper Money weaves a rich tale of economic evolution. For example, it spans colonial times to modern notes, captivating collectors and historians alike.

Colonial Beginnings

Early Paper Currency

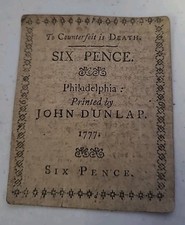

In the 17th century, colonies issued paper money to fund trade and wars. These notes, often backed by land, supported early economies. Thus, they laid currency foundations.

Challenges of Colonial Notes

Colonial notes faced counterfeiting and devaluation. Many lacked consistent backing. As a result, trust in paper money grew slowly until federal systems emerged.

Civil War and National Currency

Demand Notes of 1861

The Civil War spurred paper money growth. The U.S. issued Demand Notes in 1861 to finance the war. These notes, redeemable in coin, gained public trust.

Greenbacks and Expansion

In 1862, the government introduced Greenbacks, non-redeemable notes. They funded war efforts and became widely used. Moreover, their green ink became iconic.

Modern Paper Money

Federal Reserve Notes

Since 1913, Federal Reserve Notes have dominated U.S. currency. Featuring presidents like Lincoln and Washington, they ensure stability. Their design evolves for security.

Security Features

Modern notes include anti-counterfeiting measures like watermarks and microprinting. For instance, the $100 bill uses 3D security ribbons. These protect economic integrity.

Collector Appeal

Rare Notes and Value

United States Paper Money, like the 1896 Silver Certificates, draws collectors. Rare notes with errors or low serial numbers fetch high prices at auctions.

Certification Benefits

PMG and PCGS certify notes, verifying authenticity and condition. Certified notes, especially crisp examples, attract premium prices. Therefore, they appeal to enthusiasts.

Preserving Paper Money

Storage Tips

Collectors use acid-free sleeves to protect notes. Low humidity prevents damage. As a result, proper care preserves their value and beauty for generations.

Historical Significance

These notes reflect America’s economic journey. From colonial struggles to modern security, they fascinate collectors. Thus, they remain cherished historical artifacts.

United States Paper Money tells a story of innovation and resilience. From early colonial notes to Federal Reserve bills, it captivates enthusiasts. Consequently, this currency stands as a symbol of America’s financial heritage.

The American Civil War was a tumultuous period in U.S. history, and it required innovative financial solutions to support the war effort. In response to this need, the federal government introduced paper money known as “greenbacks.” Unlike the paper currency of the colonial era, these greenbacks were not backed by gold or silver but were instead considered legal tender by the government. This marked a significant departure from the previous monetary system.

After the Civil War concluded, the U.S. government continued its exploration of paper currency options. It introduced national banknotes, which were backed by government bonds and were redeemable for gold or silver. These notes provided stability to the nation’s currency system while supporting the post-war economic recovery.

The next major milestone in the history of U.S. paper money came in 1913 with the establishment of the Federal Reserve System. The Federal Reserve, often referred to as the Fed, became the central bank of the United States. One of its key responsibilities was the issuance of Federal Reserve Notes, a type of paper currency. These notes were backed by the assets of the Federal Reserve Banks and were also redeemable for gold or silver. The creation of the Federal Reserve System introduced a new level of stability and oversight to the U.S. monetary system.

'

'