How AI Data Centers Are Fueling the Historic Silver Rally

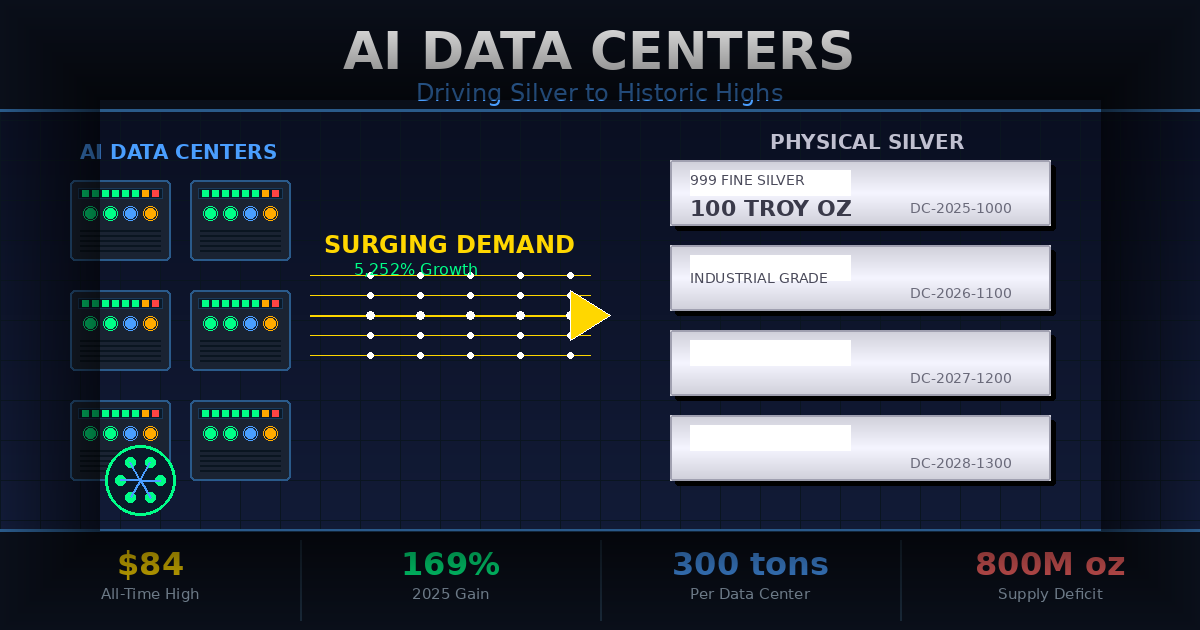

The connection between silver and AI data centers has emerged as one of 2025's most significant investment stories. After decades of trading in gold's shadow, silver shattered through $84 per ounce in late December, driven largely by explosive demand from artificial intelligence infrastructure. While currently trading around $76 after some profit-taking, the surge of AI data centers building globally has fundamentally altered silver's reputation from secondary precious metal to critical strategic asset—with prices up 169% year-to-date.

Behind this extraordinary move lies an infrastructure revolution most investors haven't yet connected to their precious metals holdings. The explosive growth of artificial intelligence is creating massive data centers that consume electricity at scales previously unimaginable, and these digital fortresses require one material above all others for their electrical systems: silver.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_7a.gif)

How AI Data Centers Drive Silver Demand: The Physical Reality Behind Digital Dreams

When most people think about AI, they picture algorithms and software. The reality is considerably more tangible. Every ChatGPT query, every AI-generated image, every machine learning model requires actual computing hardware housed in physical data centers. These facilities don't just run on electricity—they demand extreme reliability in power distribution, thermal management, and data transmission. That's where silver enters the picture.

Global IT power capacity has exploded from less than 1 gigawatt in 2000 to nearly 50 gigawatts in 2025, representing a 5,252% increase over 25 years. The International Energy Agency projects data center electricity demand will more than double by 2030, driven primarily by AI workloads. This demand from AI data centers for silver isn't speculative growth projected years into the future. Companies like Microsoft, Google, Amazon, and Meta have already committed over $200 billion to data center infrastructure through 2025, with additional billions planned beyond.

Each hyperscale data center represents thousands of servers, and within those servers, silver performs functions no other material can match at comparable cost. Its unmatched electrical conductivity makes it essential in high-performance chips, power distribution systems, and cooling infrastructure. A single 500-megawatt solar array—enough to power one large data center—requires approximately 300 metric tons of silver. Multiply that across hundreds of facilities being constructed globally, and you begin to understand the demand equation.

Silver Supply Constraints Meet Surging AI Data Center Demand

The silver market entered 2025 already facing its fifth consecutive year of supply deficits. The cumulative shortfall since 2021 has reached roughly 800 million ounces, equivalent to nearly an entire year of global production. Unlike most commodities where higher prices quickly stimulate new supply, silver operates under unique constraints that prevent rapid production increases.

Approximately 75-80% of silver production comes as a byproduct of mining other metals—primarily copper, zinc, and lead. This means even if silver prices double or triple, miners cannot simply open more silver mines. They're constrained by the economics of the base metals they're primarily extracting. New mining projects require 8-12 years from discovery to production, and ore grades have been declining globally.

The supply situation deteriorated further in late 2025 when China announced export restrictions on refined silver taking effect January 1, 2026. Under the new policy, only large state-approved companies with annual production capacity exceeding 80 tons will receive export licenses. This effectively blocks hundreds of smaller and mid-sized exporters who have served as key suppliers to global industrial users. China controls 60-70% of the global refined silver market, making these restrictions a significant structural change.

The Inventory Collapse

COMEX registered silver inventories have plummeted 70% since 2020. London Bullion Market Association vaults have lost around 40% of their holdings. Shanghai inventories sit at decade lows. At current consumption rates, some industrial regions maintain barely 30-45 days of accessible silver reserves.

This inventory depletion is creating what traders call a "physical squeeze"—a situation where the paper price of futures contracts increasingly diverges from the actual cost of obtaining physical metal. In Shanghai, physical silver has traded above $80 per ounce while COMEX futures lagged significantly lower, indicating severe tightness in deliverable supply.

Industrial Demand Reaches Critical Mass

The Silver Institute's recent report, "Silver, The Next Generation Metal," documents how industrial applications now account for the majority of silver demand, with multiple high-growth sectors accelerating simultaneously. Beyond data centers, electric vehicles require 25-50 grams of silver per unit in battery management systems and power electronics. Solar photovoltaic installations continue expanding globally, with each panel requiring silver paste for electrical conductivity. The buildout of 5G networks adds another demand stream.

This convergence of demand drivers represents something fundamentally different from previous silver rallies. The 1980 spike was driven by speculative cornering of the market. The 2011 peak followed monetary stimulus after the financial crisis. The current move reflects actual industrial consumption outstripping available supply in a way that cannot be quickly resolved.

The U.S. Department of Interior recognized this reality in 2025 by adding silver to its official list of critical minerals, alongside copper and rare earth elements. This designation acknowledges silver's strategic importance to national infrastructure and technological competitiveness.

Investment Implications

Several major financial institutions have raised their silver price targets for 2026. Bank of America projects prices could reach $65-70 per ounce, while some analysts suggest $100 is achievable if current supply-demand dynamics persist. These aren't wild speculation—they reflect structural fundamentals that differ from typical commodity cycles.

The gold-to-silver ratio, which measures how many ounces of silver equal one ounce of gold, has compressed from over 80:1 to approximately 60:1. This compression indicates silver is being revalued relative to gold based on its dual role as both monetary metal and industrial commodity. Throughout history, the ratio has occasionally moved below 40:1 during periods of extreme silver strength.

For precious metals investors, the challenge is determining appropriate allocation. If you maintain 15% of your portfolio in precious metals, mainstream portfolio modeling suggests silver could comprise 40-60% of that allocation, with the remainder in gold. The exact balance depends on your risk tolerance, investment timeline, and existing exposure to related sectors.

Many investors are now looking to buy silver bullion to capitalize on these structural trends, with silver bars and silver coins both offering direct exposure to rising prices.

Physical Metal vs. Paper Exposure

The divergence between physical and paper silver prices has important implications for how investors gain exposure. Exchange-traded funds and futures contracts provide convenient price exposure but carry counterparty risk and don't address the underlying shortage of physical metal. Direct ownership of physical silver bullion coins or bars eliminates intermediaries, though it requires secure storage.

The iShares Silver Trust, which holds physical silver in JPMorgan vaults, has risen approximately 118% year-to-date, closely tracking spot prices. Mining equities offer leveraged exposure to silver prices but introduce company-specific risks around production costs, management quality, and operational execution.

Looking Ahead

The silver market's transformation appears far from complete. Data center construction continues accelerating, with no signs of slowing as AI capabilities expand into new applications. The relationship between silver and AI data centers represents a structural demand driver that will persist for years. Electric vehicle adoption keeps gaining momentum globally. Solar capacity additions remain robust despite higher silver costs. These aren't temporary trends likely to reverse in coming quarters.

For more insights on current silver market trends and analysis, investors should monitor both supply developments and the continued buildout of technology infrastructure requiring industrial silver.

Meanwhile, supply responses remain constrained by the realities of mining economics and long project development timelines. Recycling has increased as higher prices make recovery more economical, but recycled silver still represents a small fraction of total supply. The structural deficit is projected to continue through at least 2026, with some forecasts suggesting several more years of tight markets.

Geopolitical factors add another layer of uncertainty. Trade tensions, export restrictions, and supply chain security concerns are elevating silver's strategic importance beyond its market price. Countries and companies increasingly view reliable access to critical minerals as essential to technological competitiveness and national security.

The Bottom Line

Silver's 2025 performance represents more than a spectacular commodity rally. It marks a fundamental repricing of a metal whose industrial applications have quietly become essential to the technologies reshaping modern life. The connection between AI data centers and silver demand has proven to be one of the year's most significant market developments. The data centers powering AI, the electric vehicles replacing combustion engines, the solar panels generating clean electricity—all depend on silver's unique properties in ways that have no ready substitute at comparable cost.

For investors who dismissed silver as gold's less interesting cousin, the market is sending a clear message: in an economy increasingly built on advanced electronics and renewable energy, the white metal's conductivity matters as much as its monetary history. Whether prices reach $100 or face a correction from current levels, the underlying demand drivers from AI data centers and other technology sectors aren't going away. The AI revolution isn't slowing down, and neither is its appetite for the most conductive metal on Earth.

'

'